![]() This blog post accompanies the SDPR Morning Macro segment that airs on Monday, March 2.

This blog post accompanies the SDPR Morning Macro segment that airs on Monday, March 2.

Although no one knows how the novel coronavirus will affect the global and U.S. economies, everyone agrees the outcome will be inferior to what would have occurred had the virus not struck. Putting aside for now the (significant) public-health consequences, the outbreak has the potential to disrupt significantly (aggregate) demand and supply; and in any case, the uncertainty unleashed by the outbreak is very bad for business. Admittedly, macroeconomic policies are not particularly well suited to counter epidemiological exogenous shocks. Economic contractions are typically the work of households’ or firms’ expectations or localized (and often politically induced) supply shocks—both of which macroeconomic policies typically can address—as opposed to highly contagious lower-respiratory infections—which macroeconomic policies typically cannot address. Nevertheless, now may be a good time to visit the macroeconomic tool shed, just in case. And, while we are there, an understanding of how our profession tends to prioritize, for better or worse, the various types of macroeconomic policies—monetary and fiscal, for the most part—would be useful.

Enter Robert E. Lucas.

In his presidential address delivered at the 114th annual meeting of the American Economic Association (Washington, DC, January 4, 2003), Nobel Laureate Robert E. Lucas Jr. spoke on Macroeconomic Priorities. In his address, as published subsequently in the March 2003 edition of the American Economic Review, Lucas said in part:

Macroeconomics was born as a distinct field in the 1940’s, as a part of the intellectual response to the Great Depression. The term then referred to the body of knowledge and expertise that we hoped would prevent the recurrence of that economic disaster. My thesis in this lecture is that macroeconomics in this original sense has succeeded: Its central problem of depression prevention has been solved, for all practical purposes, and has in fact been solved for many decades. There remain important gains in welfare from better fiscal policies, but I argue that these are gains from providing people with better incentives to work and to save, not from better fine-tuning of spending flows. Taking U.S. performance over the past 50 years as a benchmark, the potential for welfare gains from better long-run, supply-side policies exceeds by far the potential from further improvements in short-run demand management. (Lucas 2003, 1; emphasis added.)

Generally speaking, macroeconomic policies, which economists intend to shape general features of the macroeconomy—economic growth, unemployment, and inflation for example—include allocation policy, redistribution policy, and stabilization policy. These policies and their outcomes—intended or otherwise—are, at times, interrelated, of course. But, strictly speaking, allocation policy shapes (long-run) features of economic productivity and growth; redistribution policy reshapes the (extant) distribution of income and wealth across households; and, stabilization policy shapes the (short-run) features of the business cycle, those irregular fluctuations in aggregate economic activity—expansions, recessions, and, yes, depressions. (For more on business cycles, see the Morning Macro segment, “Growing Old(er).”)

Put differently, allocation policy is about increasing potential output—the level of output the economy would achieve if it were operating at full capacity—while stabilization policy is about shrinking the output gap—the difference between actual and potential output. In his 2003 presidential address, Lucas essentially encouraged economists to direct their efforts to allocation policies, because the “central problem of depression prevention has been solved.” And, perhaps just as importantly, Lucas effectively discouraged, in a very nuanced way, the use of fiscal stabilization policy when he claimed, “There remain important gains in welfare from better fiscal policies, but…these are gains from providing people with better incentives to work and to save, not from better fine-tuning of spending flows.” Ostensibly, the need for stabilization policy had mostly passed; and fiscal stabilization policy was the dullest tool in the shed.

Turns out reports of the death of business cycles had been greatly exaggerated.

Five years after Lucas spoke on macroeconomic priorities, the Great Recession happened. The so-called Great Moderation that had prevailed since the late 1980s was, by any measure, over. As the output gap widened to an extent not witnessed at any time since the Great Depression, macroeconomists redirected their efforts to stabilization policy. (For the record, some of us never abandoned stabilization policy in the first place.)

For the last several decades policymakers seeking to stabilize the economy have turned almost exclusively to monetary policy. (For more on monetary and fiscal policies, see Morning Macro segments, “Fed Up” and “Fiscal Therapy,” respectively.) Consider, for example, the almost-daily discussions and debates around whether, in the last decade, the Fed has done enough or too much to maintain full employment, income growth, and price-level stability; all this despite the fact that, since the Great Recession, Fed interest-rate instruments have remained relatively low, creeping just above the so-called zero lower bound and, in doing so, severely compromising the effectiveness of conventional monetary policy. In any case, fiscal stabilization policies, such as lowering taxes during the onset of a recession, remain in the macroeconomic policy toolshed; moreover, a substantial amount of economic research suggests such policies could be quite effective in the next recession, particularly in a relatively low interest-rate environment.

The work of Christina and David Romer (2010), who measure the effects on GDP of legislated tax changes passed by Congress between 1945 and 2007, offers some sense of how relatively rare fiscal stabilization policy—and, specifically, tax policy—has become in the United States. Note, legislated tax changes are distinct from so-called automatic stabilizers, which are dependent on the size of the tax base: consider, for example, how a fall in household income (caused by a recession, say) automatically reduces a household’s tax burden given a progressive income-tax system. In Figure 1, I illustrate all legislated tax changes as a percentage of GDP.

According to Figure 1, Congress has legislated tax changes throughout the sample period. In Figure 1, tax increases [decreases] appear as positive [negative] percentages of GDP. (The lines in the figure appear “spiked” because legislated tax changes are discrete events.) Of course, not all changes illustrated in Figure 1 represent stabilization policies. In some cases, Congress changes taxes in order to achieve long-run objectives, such as increasing potential output or reducing the federal debt; the authors refer to such changes as exogenous, because the changes are not (endogenous) responses to the business cycle—recessions, for example.

How to know what is an exogenous tax change versus a stabilization policy?

Glad you asked.

For each legislated tax change illustrated in Figure 1, Romer and Romer (2010) (painstakingly) examine the narrative record in order to determine whether the change is exogenous—read, not a reflection of stabilization policy—or otherwise. Illustrations 1 and 2, which appear as exhibits in Romer and Romer (2010), offer some sense of this narrative analysis; the authors’ method is instructive, worthy of a paragraph or two of our attention.

Illustration 1 is a narrative record of the Revenue Act of 1964, which, according to Romer and Romer (2010), Congress intended to increase long-run economic growth and, thus, potential GDP. The Revenue Act of 1964 was not an act of fiscal stabilization policy. To substantiate their claim, the authors offer several pieces of evidence, some of which appear in the text of Illustration 1. Note, for example, the remark the authors cite from President Kennedy regarding the tax cut: “I have not been talking about a different kind of tax cut, a quick, temporary tax cut, to prevent a new recession.” Similarly, the authors cite the 1963 Economic Report of the President, which included the clarification, “We approach the tax revision, not in an atmosphere of haste and panic brought on by recession or depression, but in a period of comparative calm.”

Illustration 1: An Exogenous Tax Change

In rather stark contrast, Illustration 2 is a narrative record of the Tax Reduction Act of 1975, which, according to Romer and Romer (2010), Congress intended to counteract the recession that began in November 1973 and reached its trough in March 1975. Thus, the Tax Reduction Act of 1975 was a (countercyclical) fiscal stabilization policy. Again, to substantiate their claim, the authors offer several pieces of evidence, some of which appear in the text of Illustration 2. Note, for example, the remark the authors cite in the President’s Annual Budget Message to Congress for fiscal year 1976: “It must be clearly understood that these problems are serious and that strong remedies are fully justified. The economy is in a recession.”

Illustration 2: A Countercyclical Tax Change

Finally, in Figures 2 and 3, I illustrate the outcomes of the Romer and Romer (2010) narrative analysis; in Figure 2, I illustrate all exogenous tax changes (of the sort described in Illustration 1) and, in Figure 3, I illustrate countercyclical tax changes (of the sort described in Illustration 2) and spending-driven tax changes. The data in Figures 2 and 3 together yield Figure 1.

According to Figure 3, fiscal stabilization policies (pictured in blue) have been relatively rare since the mid 1970s, even though the United States economy suffered economic contractions in January 1980, July 1981, July 1990, and March 2001; Congress responded only to the latter with a countercyclical legislated tax change—a cut in that case. As Romer and Romer (2010, 777) observe, “The heyday for countercyclical tax changes was the ten years from 1965 to 1975.” The authors’ study does not include the Great Recession, in response to which Congress (and Presidents Bush and Obama respectively) responded—somewhat modestly and with some delay in light of the severity of the Great Recession—with the Economic Stimulus Act of 2008 and the American Recovery and Reinvestment Act of 2009.

Why is fiscal policy relatively unpopular?

Theories for why fiscal policy has generally fallen out of favor relative to monetary policy abound. Some policymakers argue fiscal policy is ineffective; incidentally, Romer and Romer (2010) conclude otherwise. Meanwhile, political scientists have for some time offered a most-intriguing—and quite persuasive—alternative explanation. For example, according to Sarah Binder and Mark Spindel, authors of The Myth of Independence: How Congress Governs the Federal Reserve, the Fed’s authority to manage the economy with monetary policy has increased over time, while efforts to employ fiscal policy have decreased, as Congress has sought to hold the Fed alone responsible for poor macroeconomic performance; after macroeconomic troubles, Congress has often increased the central bank’s authority and, in turn, its culpability (Binder and Spindel 2017).

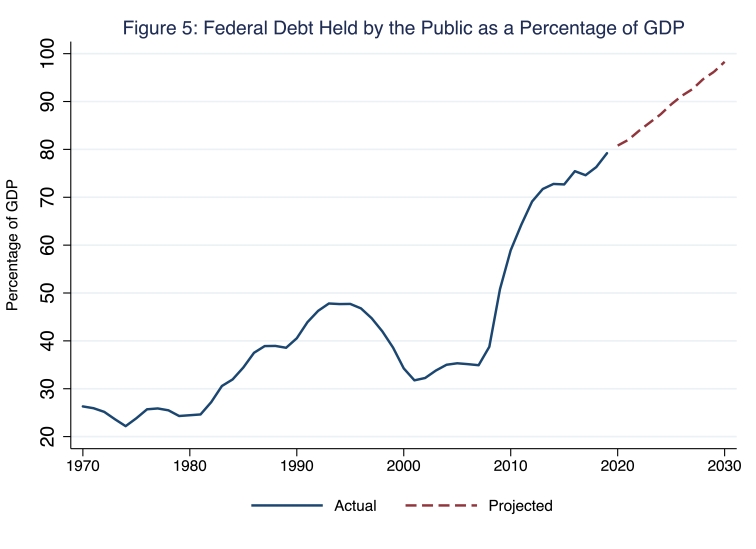

To be sure, fiscal policy is not perfect. It includes lengthy so-called inside lags—the time Congress takes to pass legislated tax changes, for example; and, in any case, it is inherently politicized. For many economists, including, for example, Harvard University’s Kenneth Rogoff in a recent contribution to Project Syndicate, these imperfections are fatal flaws. And, in any case, legislated tax changes and government spending change the budgetary position of the federal government and, in turn, its debt position. In Figures 4 and 5, I illustrate, respectively, the U.S. federal budget balance and the U.S. federal (public) debt, each as a percentage of GDP, since 1970, complete with projections (in red) by the Congressional Budget Office (CBO) for the next decade.

According to Figure 4, as of 2019, the U.S. federal budget deficit registered 4.6 percent of GDP; and the CBO projects this percentage to increase (in absolute value) to 5.4 percent of GDP by 2030. Meanwhile, according to Figure 5, the federal debt held by the public registered 79.2 percent of GDP; and the CBO projects this percentage to increase to 98.3 percent of GDP by 2030.

So, yes, fiscal stabilization policy has immediate budgetary consequences; lowering taxes in response to a recession reduces revenues to the U.S. Treasury, for example. And, for the foreseeable future, the federal budgetary position is, well, not great. Nevertheless, many economists increasingly emphasize at least two reasons why fiscal stabilization policy may have fewer negative long-term budgetary consequences than some observers assume.

First, if fiscal stabilization policy preserves (or restores) the growth of GDP during a recession, then the debt need not rise as a percentage of GDP by as much at it might rise otherwise; put differently, absent the fiscal stabilization policy, the debt might rise as a percentage of GDP simply because the growth of GDP falls. Moreover, in the current low-interest-rate environment (in which conventional monetary policy is relatively ineffective), deficits need not increase the debt as a percentage of GDP because the cost of servicing government debt is less than the growth of GDP. For example, according to Figure 6, in 2018, the yield to maturity on 10-year and 30-year government bonds averaged 2.14 percent and 2.58 percent, respectively; meanwhile, the growth of nominal GDP (not pictured here) registered 4.12 percent.

The second reason why fiscal stabilization policy may have fewer negative long-term budgetary consequences is that such policy is, at least in principle, countercyclical. So, for example, a legislated tax cut during a recession need not remain in place once the recession is over and, thus, the growth of GDP has returned to its long-run level.

Increasingly, proponents of fiscal stabilization policy argue for policy rules that cut taxes or increase stimulus (transfer) payments based on certain features of the economy. Such rules are conceptually akin to automatic stabilizers; though these proposed rules are substantially more robust, intentional, and active than automatic stabilizers. For example, the proposed Sahm Rule—named for Claudia Sahm, the director of macroeconomic policy at the Washington Center for Equitable Growth and formerly with the Board of Governors of the Federal Reserve—directs stimulus payments to households when the three-month-average unemployment rate rises by at least a half of a percentage point above the lowest monthly unemployment rate in the previous 12 months. This criterion—the subject of a future Morning Macro segment—has predicted every recession since 1970; and, importantly, it has not signaled false positives—signals of recessions that turn out not to be.

The idea here is that once policymakers—and legislators—set the policy rule, fiscal stabilization policy would be implemented if the economy underperforms (triggering the need for a policy response), whether or not policymakers were willing to implement fiscal policy at that moment. Moreover, because households and firms would understand the trigger rules—the Sahm Rule, for example—ahead of a recession, households and firms may not curtail spending in ways that would otherwise worsen the recession.

To be sure, monetary and fiscal policies are fundamentally ill suited to deal with the immediate economic consequences of an ongoing epidemiological threat. Nevertheless, macroeconomic polices could deal with the economic troubles left in the wake of an epidemiological threat (which too shall pass). When that time comes, we should remember that fiscal stabilization policy may not be the dullest tool in the shed after all.

References

Binder, Sarah and Mark Spindel. 2017. The Myth of Independence: How Congress Governs the Federal Reserve. Princeton: Princeton University Press.

Romer, Christina D. and David H. Romer. 2010. “The macroeconomic effects of tax changes: Estimates based on a new measure of fiscal shocks.” American Economic Review, 100, 763-801.

One thought on “dullest tool in the shed”